Isn’t there something you’d rather be doing than worrying about your investments?

© 2010 TJ Stearns, Inc. All Rights Reserved.

Financial & Investment News

TJ Stearns - Established - Certified

Contact TJ Stearns Today!

Find out what you need from

a financial planner.

Name:

Email:

Market Resources - TJStearns.com

TJ Stearns, Inc. offers market resources for the convenience of one-stop comprehensive financial planning, and estate protection. For business owners, we provide employee benefit services such as qualified and non-qualified plan design, investment services, retirement education, group health insurance, group life and disability insurance.

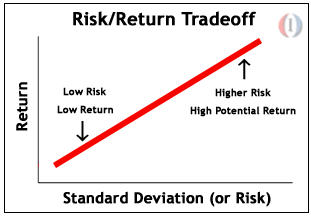

The risk-return tradeoff is the balance an investor must decide on between the desire for the lowest possible risk for the highest possible returns. Remember to keep in mind that low levels of uncertainty (low risk) are associated with low potential returns and high levels of uncertainty (high risk) are associated with high potential returns.

The risk-free rate of return is usually signified by the quoted yield of "U.S. Government Securities" because the government very rarely defaults on loans. Let's suppose that the risk-free rate is currently 6%. Therefore, for virtually no risk, an investor can earn 6% per year on his or her money. But who wants 6% when index funds are averaging 12-14.5% per year? Remember that index funds don't return 14.5% every year, instead they return -5% one year and 25% the next and so on. In other words, in order to receive this higher return, investors much also take on considerably more risk.

The following chart shows an example of the risk/return tradeoff for investing. A higher standard deviation means a higher risk:

Advisory services provided by Brookstone Investment Advisory Services an SEC registered RIA